What recent UK enforcement actions reveal about sanctions and PEP screening

In January 2026, a major UK banking institution was fined £160,000 by the UK’s Office of Financial Sanctions Implementation. The failure was not caused by a lack of policy, training, or intent. It came down to a variation in how a name appeared on identity documents.

That small inconsistency allowed a sanctioned, politically exposed individual to open an account and process payments. Although the individual was later identified through additional checks, the breach had already occurred. Regulatory action followed, along with reputational damage and increased scrutiny.

This case highlights a reality many organisations underestimate. Sanctions and PEP risk rarely comes from dramatic failures. It comes from small gaps in screening processes that were assumed to be sufficient.

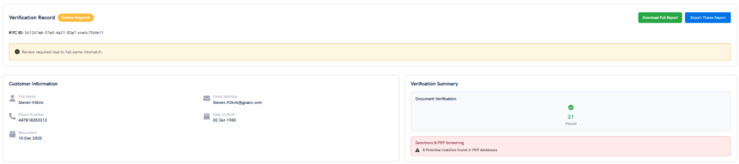

With Goidentity we clearly show at the top of the report if there are any inconsistencies with the ID check, flagging the issue instantly and clearly.

If your screening does not catch real-world data variation, it is not reducing risk.

Enforcement is no longer rare

This was not a one off.

In March 2025, OFSI fined a London law firm £465,000 after payments were made to sanctioned Russian banks while they were closing their Moscow office. They self reported. They cooperated. The regulator still concluded their controls were not robust enough.

In July 2025, the Financial Conduct Authority fined a UK digital bank £21.1 million. The issue was systemic weaknesses in financial crime controls. Poor onboarding. Weak monitoring. Implausible customer data getting through unchecked.

Earlier that same year, HM Revenue and Customs issued more than £1.6 million in penalties to estate agents for basic AML failures. Not complex schemes. Not clever criminals. Just foundational compliance that was not being done properly.

The pattern is clear.

- Sanctions and PEP screening is not a specialist extra any more.

- It is a baseline expectation across sectors.

Why does screening still fail?

Most organisations do not fail because they do not care.

They fail because their tools are not built for the real world.

- Names are messy.

- Spellings change.

- Transliterations vary.

- Spacing and abbreviations are inconsistent.

If your matching logic is rigid, it will miss things. Every miss is risk sitting quietly in your customer base.

Another issue is mindset. Screening gets treated as a one off onboarding tick box, not an ongoing risk control. Over time, that risk builds. Usually invisibly. Until a regulator finds it.

Then there is cost and complexity.

Too many teams still think proper sanctions and PEP screening means long contracts, big upfront fees, and heavy integration projects. So they delay. Or they only screen some customers. Or they rely on manual workarounds.

Regulators are making it very clear now. Those excuses do not stand up anymore!

What good screening looks like today

Modern screening needs to do three things well.

- It must be accurate enough to catch subtle variations.

- It must be fast enough to work in real time.

- It must be simple enough that teams actually use it consistently.

And one more thing that often gets ignored.

It must be affordable.

If screening feels expensive, it gets used selectively. Selective screening is where gaps appear. Gaps are where enforcement starts.

A simpler approach with GoIdentity

At GoIdentity, we started with a different assumption.

Strong compliance should not be heavy, slow, or locked behind contracts.

Our Sanctions and PEPs Screening check plugs straight into onboarding and identity verification journeys. No contract to sign. No setup fee. No long project before you see value. You top up your account and start screening.

The pricing is simple on purpose.

Each Sanctions and PEPs check costs £0.40.

That makes it realistic to screen consistently, not just in “high risk” cases. It helps you catch issues early, when they are cheap and easy to deal with, not when they turn into regulatory findings.

Start screening straight away

- No contract

- No upfront fees

- Just £0.40 per Sanctions and PEPs check

- Plus, a range of other identification checking services.

£0.40 versus six figure fines

Look at the numbers.

- Hundreds of thousands in fines.

- Millions in other recent cases.

- Years of regulatory scrutiny and remediation.

All because controls did not quite work in the messy reality of real customer data.

A few hundred pounds a month in proper screening is nothing in comparison. More importantly, it protects your reputation, your customers, and your relationship with regulators.

Sanctions and PEP screening is not the most visible part of your customer journey.

But when it fails, it becomes the most expensive.

Sometimes the difference between staying compliant and facing enforcement really is £0.40.

Ready to make the shift?

Digital trust is the new currency of business. Identity verification isn’t optional anymore, it is the foundation of compliance, security, and customer confidence.

👉 See how Goidentity can help you turn compliance into a competitive advantage: www.goidentity.com